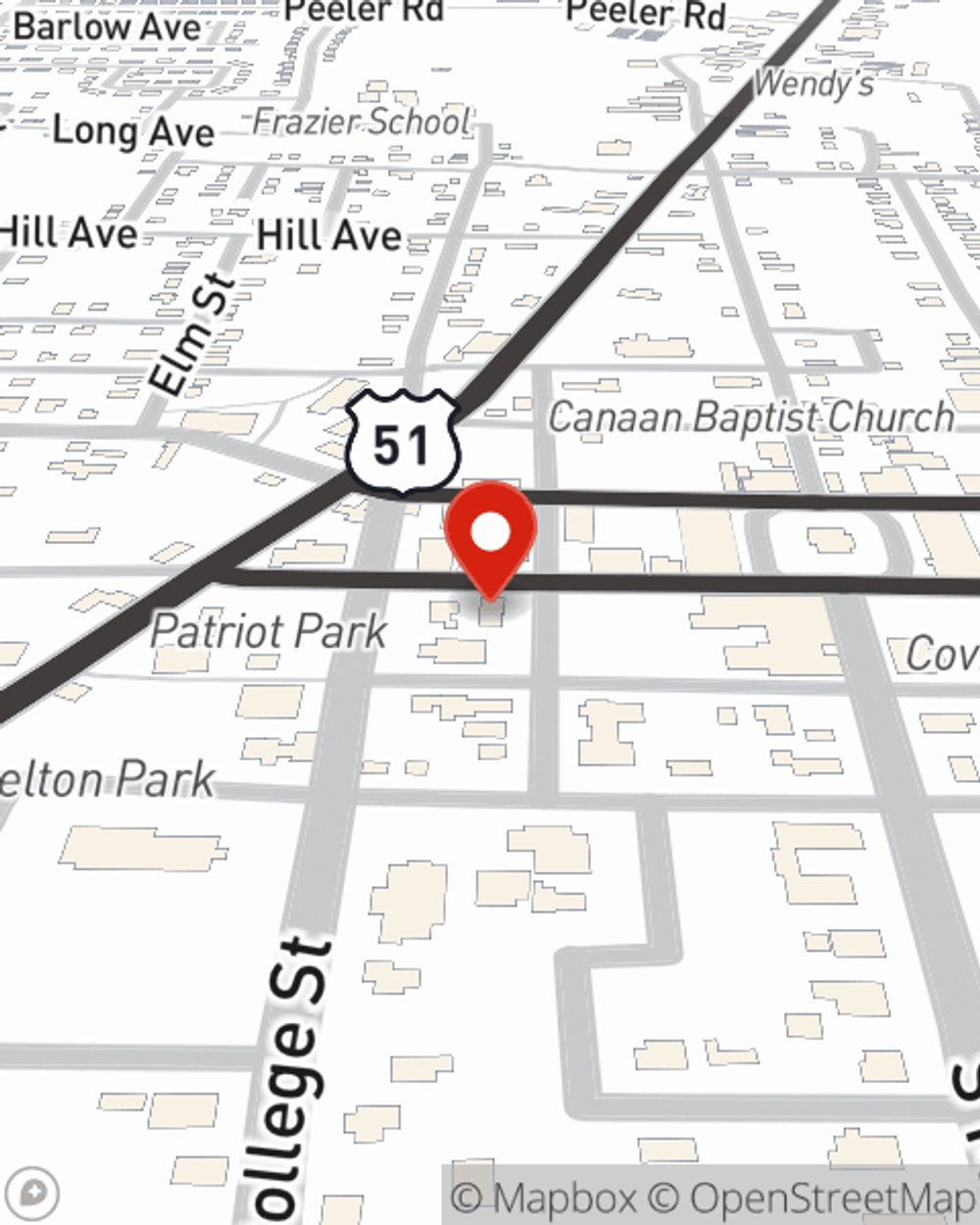

Renters Insurance in and around Covington

Welcome, home & apartment renters of Covington!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Covington

- Tipton County

- Brighton

- Atoka

- Munford

- Burlison

- Mason

- Drummonds

- Millington

- Tennessee

There’s No Place Like Home

It may feel like a lot to think through family events, work, your sand volleyball league, as well as savings options and coverage options for renters insurance. State Farm offers straightforward assistance and incredible coverage for your musical instruments, sports equipment and linens in your rented apartment. When the unexpected happens, State Farm can help.

Welcome, home & apartment renters of Covington!

Rent wisely with insurance from State Farm

Why Renters In Covington Choose State Farm

You may be wondering: Is renters insurance really necessary? Think for a moment about how much it would cost to replace your possessions, or even just one high-cost item. With a State Farm renters policy behind you, you don't have to be afraid of abrupt water damage from a ruptured pipe. Renters insurance doesn't stop there! It extends beyond your rental space, covering personal items you've placed in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. As more of your life is online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Brad Carlisle can help you add identity theft coverage with monitoring alerts and providing support.

State Farm is a dependable provider of renters insurance in your neighborhood, Covington. Get in touch with agent Brad Carlisle today for help understanding your options!

Have More Questions About Renters Insurance?

Call Brad at (901) 476-7500 or visit our FAQ page.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Brad Carlisle

State Farm® Insurance AgentSimple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.